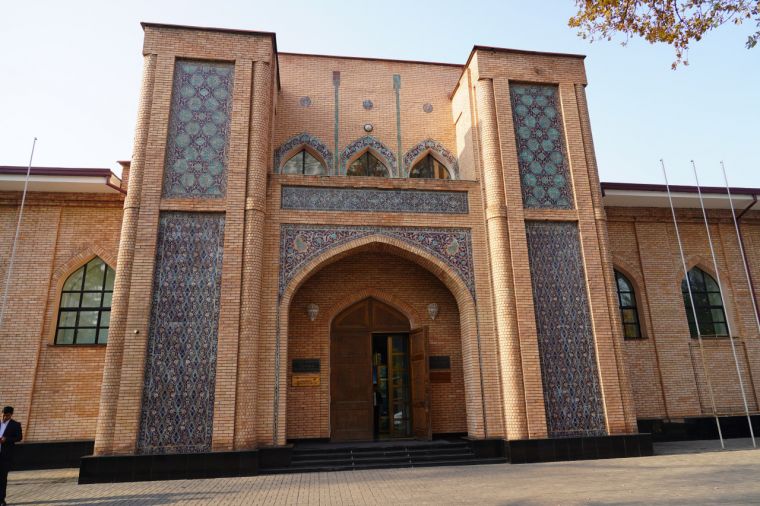

Tashkent city

It is true that Uzbekistan is the center for historical buildings. Some of them are more than three thousand years. For example, “Hasti Imam” complex in Tashkent with it’s the first Quran of Usman dating to the VII century attracts thousands of tourists. There are many historical spots in Bukhara as well, one of them is Bakhauddin Naqshband memorial complex. Bahauddin Naqshband rahmatullahi alayh lived in XIV century and founded Naqshbandiya path of Sufism.

Notes for tourists……..

All efforts are being done to make better impression for tourists visiting Uzbekistan. For this reason a new initiatives are being put forward to develop tourism sphere. Starting from February 10th, 2018 the citizens form the following countries: Israel, Indonesia, Malaysia, South Korea, Turkey, Japan and Singapore can visit Uzbekistan for 30 days. For 39 countries visa procedures have been simplified. So, as a result 16 countries can visit Uzbekistan without entry visas.

Up to this day only 9 countries have been using non-visa entry status. Those countries were Azerbaijan, Armaniston, Belorussia, Georgia, Kazakhstan, Moldova, Russia and Kyrgyzstan.

Starting from 1st May, 2018 tourists are going to receive on arrival short term visas and later in summer E-visa is expected to be implemented. Then tourists would be able to do all procedures online including payment.

Besides, Uzbekistan Airlines, national air company is widening its routes in Scandinavia and South-East Asia with direct flight offers.

US State Department included Uzbekistan to the list of the most secure and trusted countries for US tourists on January 10, 2018.

These all proves that Uzbekistan will become one of the most attracted touristic countries in the world.

Press Service,

Muslim Board of Uzbekistan

As part of the “Week of Tolerance”, which encompasses various events aimed at strengthening interethnic and interfaith friendship, harmony, and solidarity across our country, a photo exhibition entitled “Uzbekistan – The Land of Tolerance” was held at the Tashkent House of Photography.

The event was attended by representatives and staff of the Committee on Interethnic Relations and Friendly Ties with Foreign Countries, the Committee on Religious Affairs of the Republic of Uzbekistan, activists of national cultural centers and friendship societies, representatives of religious confessions, and members of the media.

The exhibition featured more than 100 photographs reflecting events organized in cooperation with national cultural centers and friendship societies, as well as the lifestyle, culture, and traditions of various ethnic and religious communities living in Uzbekistan.

It should be noted that today, over 130 nationalities and ethnic groups, along with representatives of 16 religious confessions, live in Uzbekistan in an atmosphere of tolerance, friendship, and unity. Events held within the framework of the Week of Tolerance are among the noble initiatives that call the peoples of the world to peace and solidarity.

Muslim Board of Uzbekistan – Press Service