Tashkent city

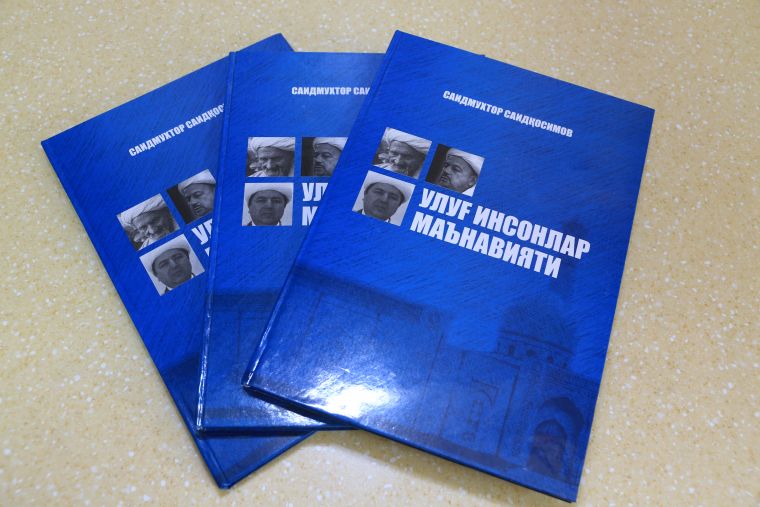

On December 18, 2017 Muslim Board of Uzbekistan hosted an event dedicated to the presentation of Professor Saidmukhtor Saidkasimov’s book under the title “The enlightenment of great pople” devoted to the 80th anniversary of the scholar of oriental studies and diplomat Shamsiddin Bobokhonov. The Academic of the Academy of Sciences of Uzbekistan, Doctor of Philological Studies, Professor Ne’matulloh Ibrohimov, Doctor of Economic Studies, Professor Nurislom Tuxliyev and The Chairman of Muslim Board of Uzbekistan Usmankhan Alimov took part in the event with their presentations. Video script devoted to the autobiography of Shamsiddin Bobokhonov was played on the screen.

Heads and delegates from the Committee on religious affairs under the Cabinet Ministers of Uzbekistan, Muslim Board of Uzbekistan, Islamic Civilization Center of Uzbekistan, scholars of oriental studies, imams and students from Tashkent Islamic Institute and Tashkent Islamic University also participated in the event.

During the meeting Muftiy Usmonkhon Alimov noted that Shamsiddin Bobokhonov’s leadership of Muslim Board had been in 1982-1989, the period of historical time when atheists rein was full of difficulties.

Muftiy made the comparison of that time with the following hadith from our prophet Muhammad sollalohu alayhi wasallam: “There would be times for my ummah when they would keep patience in religious practices like the one who holds fire in his arms”.

It was underlined that the lives of these kinds of people are worth to take as an example. Talking about scholars Imam A’zam said the following: “It is better for me to sit with the circle of scholars rather than reading books, because stories talk about the upbringing of people”

Press service,

Muslim Board of Uzbekistan

The Central Bank expects to establish at least 10 full-fledged Islamic banks by 2030. Also, “Islamic windows” — branches providing Sharia financial services — will appear in three state banks. The Central Bank considers Islamic finance as a tool for withdrawing funds from the shadow economy.

Why is this important

According to a UNDP survey, 68% of Uzbekistan’s population does not want to use traditional banking services due to religious beliefs. Launching Islamic banks will expand financial inclusion, increase bank assets, and reduce the share of the shadow economy. This is the largest transformation of the financial system since independence.

What happened

Draft law

The document introduces the concepts of “Islamic banking activity”, “Islamic financial operations”, “investment deposit”, and others. A separate license is provided for Islamic banks. Classical banks will be able to organize “Islamic windows” if they have a license.

Islamic products: Murabaha (deferred trade financing), Mudaraba (investment partnership), Mushoraka (joint venture), Wakala (agency financing), Salam (prepayment of goods).

Features of regulation

Assessment of demand

The Deputy Chairman of the Central Bank clarified: when we talk about 50-60% of the population preferring Islamic finance, we are talking about those who prefer it. Those who categorically refuse traditional services are significantly fewer.

Context

Islamic finance prohibits the collection of interest (riba) and speculative operations. Instead, partnership models are used, where the bank and the client share profits and risks. Uzbekistan is a predominantly Muslim country (90%+ of the population), where a significant portion of citizens avoid traditional banks for religious reasons.

Creating 10 Islamic banks by 2030 is an ambitious task, given that there are currently around 35 commercial banks operating in the country. “Islamic windows” in state banks will allow large players (Uzpromstroybank, Halyk Bank, Asaka Bank) to enter a new segment of clients without creating separate structures.

The Central Bank sees Islamic finance as a tool for combating the shadow economy: religiously motivated citizens who do not trust traditional banks will be able to legalize funds through Sharia products.

A separate tax regime may include benefits for Murabaha-type operations, where the bank formally purchases goods and resells them to the client with a markup — to avoid double taxation.